Circle S-1 and the future of money

Stablecoins are having a moment in fintech. Dozens of startups have raised funding to rethink the space, and nearly every major fintech company is either integrating stablecoins—or promising it will soon. The market remains dominated by Tether, with over $150 billion in circulation. USDC, issued by Circle, is the second-largest, with a circulating supply of roughly $60 billion.

A few weeks ago, Circle filed its S-1 to go public on the NYSE—offering the first real look into its financials. This post analyzes the S-1 filing to uncover the strengths and weaknesses of Circle’s business model and place it in the broader context of the stablecoin industry.

Circle S-1

Circle's revenue model is simple: it earns interest on the reserves backing USDC. In 2024, over 99% of its $1.68 billion in revenue came from this source. These reserves are held primarily in short-term U.S. Treasuries and cash equivalents, managed via institutional partners like BlackRock.

Thanks to a high-rate environment, Circle has turned profitable over the last two years. But the filing reveals something more interesting: a growing share of this reserve-generated income is paid out as distribution and transaction costs.

In 2022, about 40% of Circle’s revenue went to distributors. That figure rose to 50% in 2023 and exceeded 60% in 2024.

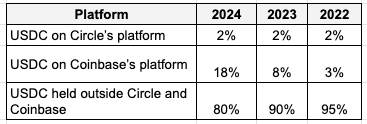

The primary reason is the evolving commercial agreement with Coinbase. In broad terms:

100% of the interest income on USDC held on Coinbase's platform is allocated to Coinbase

50% of the interest income on USDC held outside of Coinbase's platform is also allocated to Coinbase

As Coinbase’s share of USDC custody grew, so did the payouts—reaching $908 million in 2024 alone. The filing also discloses a $74.1 million one-time payment to Binance for strategic distribution, but it makes no mention of similar deals with other exchanges.

These revenue-sharing agreements have a profound impact on Circle's gross margins: while nominal gross margins may appear healthy, effective margins after partner payouts hover around 30–39%, limiting Circle's profitability. These arrangements significantly impact Circle's gross margins, effectively capping them despite the high-interest income generated from USDC reserves. In short: distribution eats the yield.

An uncertain future

Circle's business model, while currently profitable, in my opinion reveals some structural fragilities:

Overdependence on interest rates: the model thrives on high rates but is exposed to severe margin compression in downturns

Limited revenue diversification: with nearly all revenue tied to reserve yield, Circle lacks fee-based or product-based alternatives

Partner-heavy cost structure: fixed revenue-sharing terms mean Circle can't easily scale profitably unless it renegotiates or adds high-margin products.

This raises questions about long-term sustainability: if stablecoin adoption grows but rates fall, Circle could paradoxically become less profitable despite broader usage. Moreover, the model's defensibility is weak and many players entering the stage, with better economics and distribution capabilities, could pose a serious threat.

New gatekeepers?

Stripe announced last week that they are releasing stablecoin financial accounts in 101 countries. This will be a basic account through which business can send and receive funds via crypto and fiat rails and store crypto balances on Stripe.

This move aims at positioning Stripe as the financial gateway for clients to move fiat and stable, disintermediating them from the underlying tokens that are used to complete the transfer. If this proves successful, once Stripe owns the relationship with the end-user it could become irrelevant whether the value is transferred via USDC or via a USDB (USD pegged stablecoin issued by Bridge - recently acquired by Stripe).

Topology pressure

Circle is deeply embedded in today's stablecoin market architecture: a “few regulated issuers (Circle being one of them) act as gatekeepers to a mesh network, coexisting with a dominant unregulated issuer (Tether) loosely tethered (…) to the monetary centre”. In this topology, value accrues closest to the center—Circle being one of those nodes.

But blockchain rails are eroding that structure. When value is locked too tightly, pressure builds to redistribute it.

As Luca Prosperi - M0 founder - explored in “A Network Model of Money”, new topologies could emerge where issuance and value flow are more decentralized. In such a paradigm, Circle—and Tether—may find their models structurally incompatible.

Conclusions

Circle appears to be thriving—but its foundations are fragile. This IPO likely represents a well-timed bid to go public while the stablecoin narrative is hot and interest rates are still elevated.

As I argued in Stablecoin 2.0, we’re still living in version 1.0 of this market. The current topology may not last. And in the future, Circle may find itself trying to fit into a new monetary architecture it wasn’t designed for.

The real challenge will be finding a role in that future.

Resources

Circle S1

Stripe announcement https://x.com/patrickc/status/1920195203052572811

M_0 -